ECONOMIC MODELING

Milliman Economic Scenario Generator

Formerly known as Milliman CHESS, our award-winning solution delivers a distinctive combination of production efficiency and expertise support, along with state-of-the-art modelling catalog and high-quality data for both market-consistent and real-world applications.

Reliable, quick validation is imperative

To match demanding timelines for risk-management decisions and regulatory compliance, you need to scale and automate the ESG production process. At the same time, you need results you can trust.

Benefit from best-in-class ESG software and service

Achieve a high level of automation and scalability by integrating the Milliman Economic Scenario Generator into your existing systems. The cloud-based application delivers economic scenarios in a scalable environment, with easy-to-understand visualizations for rapid validation. The Milliman Economic Scenario Generator was named Best ESG Software by Insurance ERM.

Benefits of the Milliman Economic Scenario Generator

Take advantage of the cloud

Execute the calibration, simulation, and validation functionalities from any vendor or in-house system through the integration-ready RESTful API of the Milliman Economic Scenario Generator.

Rely on best-in-class industry experience

Receive expert advice to ensure you use the best model to achieve your goals for optimal efficiency, risk-management accuracy, and regulatory compliance.

Gain trustworthy results

Review audit features, model documentation, and Excel files that detail step-by-step derivations of economic scenarios. The Milliman Economic Scenario Generator’s calibration reports are based on alliance partnerships with the most renowned financial data providers and are subject to thorough data quality assessments.

Features of the Milliman Economic Scenario Generator

Broad set of models to choose from

Leverage Milliman’s comprehensive model catalog as you work with our team to determine which models apply to your specific scenarios.

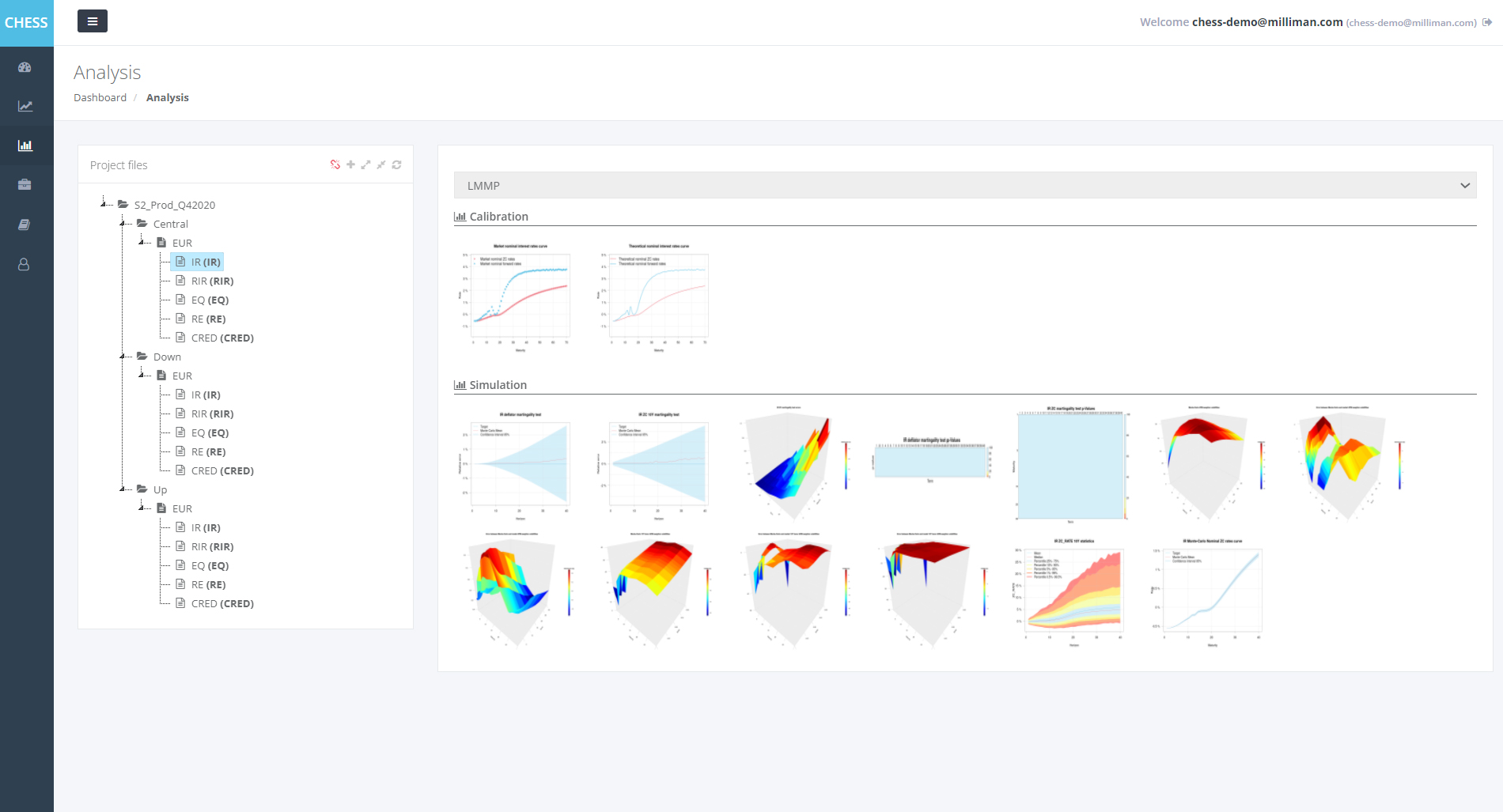

Visual synthesis

See validation results quickly in the form of tables and graphs.

Available support

Get help from Milliman consultants as you navigate any external or internal review of results generated by the Milliman Economic Scenario Generator.

Global reach

Access services from the Milliman Economic Scenario Generator deployed in Europe, the United Kingdom, United States, and Asia. Methodologies and data choices from the most renowned data providers have been tailored to reflect the highest degree of robustness and compliance in each market, including Solvency II, IFRS 17, and LDTI.

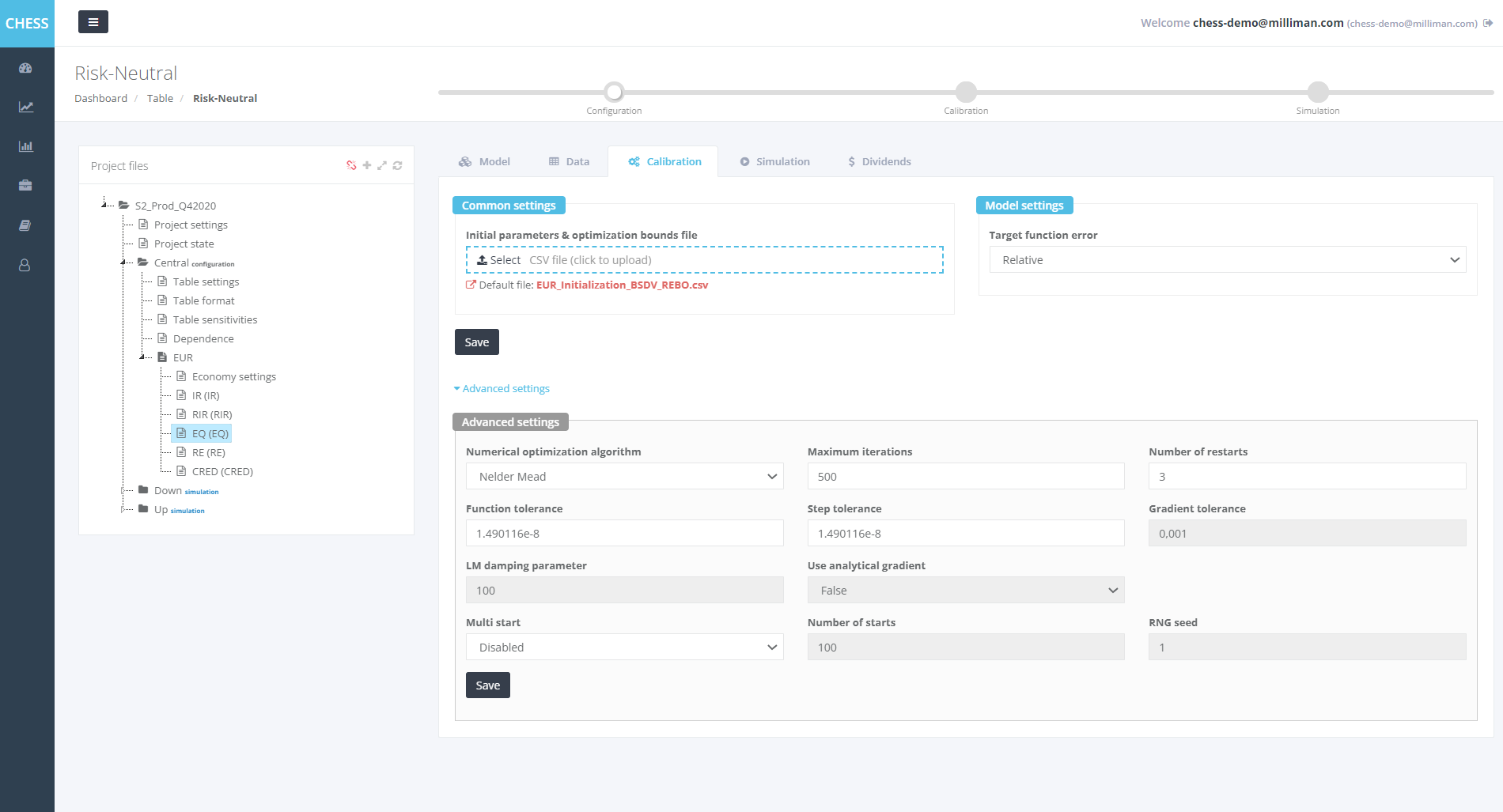

Advanced control on ESG configuration & validation is made easy — for better accuracy and compliance.

Customization

Use advanced and custom parameters for model selection, data loading, calibration, and simulation steps.

Validation

Enable ESG experts and risk managers to exhaustively validate model performance using visualizations and data.

See how the Milliman Economic Scenario Generator is helping businesses globally

Products related to Milliman’s Economic Scenario Generator

Integrate

Automate and accelerate actuarial modeling and reporting with a powerful, cloud-based solution.

Milliman Mind

Milliman Mind is a flexible and easy-to-use web-based platform that automatically converts Excel spreadsheets into more powerful models.