Rent, buy or shared-equity mortgage: Finding the best option

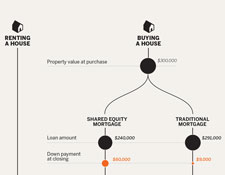

We can look backward with actual data and forward with predictive analytics and use that information to help in our home-buying decision-making process. There are three defined dwelling paths for borrowers: renting, buying a property with a traditional low down payment mortgage, and buying a property using a shared-equity (also known as shared appreciation) mortgage. Using historical information, this article takes a retrospective look at these three options for a hypothetical borrower, and how this person would have fared under a certain set of realistic conditions.

This paper is for informational purposes only and is not intended to convey any type of advice; legal advice, investment advice or tax advice.

This article was published by MortgageOrb.