In a rapidly evolving world, how can title insurance keep current? Insurtechs are changing the way many property and casualty insurers are doing business and, despite being a relatively new phenomenon, have already begun disrupting the industry. Advancements in technology such as artificial intelligence, machine learning, the Internet of Things, smartphone apps, and drones simplify processes and improve customer experience. 1 Insurtechs can also be used to improve distribution channels and management philosophies, through company aggregation, changing the insurer/agent relationship or creating a peer-to-peer relationship.

However, insurtechs have only just started to affect the title industry. This presents unique opportunities for new and established insurers in the title space to innovate and gain market share.

A primer on title insurance

Title insurance protects against financial loss due to defects in a property title, which could be caused by mistakes in recording of legal documents, incomplete public records, fraud and forgery, errors in title search or examination, improper closing and escrow procedures, or defalcations (misappropriation of funds). There are two types of title policies, loan and owner policies. A loan policy covers the lender’s interest and is needed for the original home purchase and refinance purchases. An owner’s policy protects the owner’s interests and is only issued when the property is originally purchased.

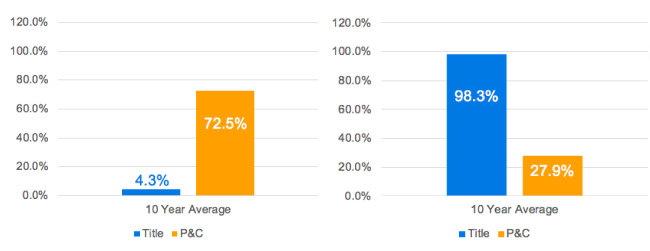

Unlike many other property and casualty insurance policies, where premiums are collected annually or biannually, title insurance is a one-time purchase at the time the home is acquired or refinanced, and losses can be reported for 20 or more years. Another key difference between title insurance and property and casualty lines of business is the make-up of the combined ratio. Title insurance has a lower loss component and higher expense component (see Figures 1.0 and 1.1 below).

|

Figure 1.0: Loss ratios* |

Figure 1.1: Expense ratios* |

*Based on data from S&P Global Market Intelligence

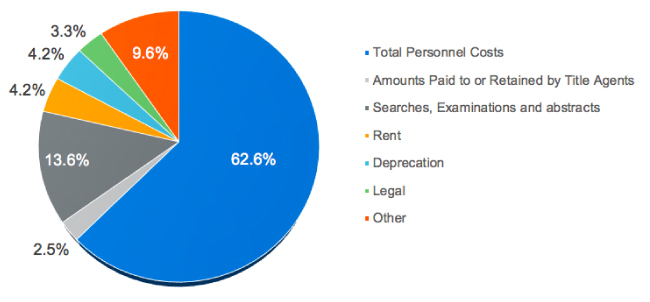

Title insurance is more expense-driven, with most of its premium spent prior to the policy being written. Title policies can be written directly or through an agent. For direct agents, the majority of expenses are from personnel costs, with the second-largest expense from searches, examinations, and abstracts (see Figure 2.0). We assume that, similar to direct written business, agent business’s highest expense category is personnel costs – whether to employees or affiliated contractors.

Figure 2.0: Direct agent expenses**

*Based on data from S&P Global Market Intelligence

Insurtech opportunities for title writers

Given that title insurance is expense-driven, insurtechs looking to get into title insurance should focus on lowering the expense ratio, such as personnel costs and title searches, instead of the loss ratio. To help understand insurtech opportunities in title insurance, we first look at how insurtechs have influenced the property and casualty insurance industry. In some instances, what has occurred in the property and casualty market is directly translatable to title insurance. In others, the unique characteristics of title insurance, as described above, will not allow for a smooth transition.

Technology is already influencing the mortgage business with the development of e-mortgages. The move to digital mortgages helps to centralize the transaction for all stakeholders (consumer, realtor, lender, and title company), standardize the transaction, modernize the consumer experience, and create a path for evolution and implementation of the digital revolution. All of these changes, created by the addition of technology, serve to make life simpler as well as reduce costs, errors, and redundancies. 2

One way these efficiencies in the title process can be achieved is through improvements such as software add-ons or external apps. Artificial intelligence could be used to help cut down the time required to perform title searches and examinations and thus cut the expenses associated with these tasks. Smartphone apps could be used to connect consumers directly with title underwriters rather than agents. The direct transactions streamline the application process and have less associated expense.

Additionally, existing digital mortgage platforms have begun expanding to include some gateways to purchasing title insurance, such as digital signings at closings. In the future, title insurers could use the digital transformation to help cut down on the time and money spent on the underwriting, search, examination, and other steps in the title process. By integrating within the digital mortgage platform, a title underwriter has the ability to gain access to all of these consumers directly, providing an avenue of writing directly. As described earlier, direct transactions have less expense for the underwriter because they remove the independent or affiliated agent from the mix.

Of course, digital integration for title insurance brings additional risk such as a greater potential for misrepresentation, and therefore, fraud.3 These fraud and forgery claims tend to have a higher severity, which will increase the loss ratio. However, the decrease in expense could more than offset an increase in losses, and therefore lower the combined ratio and increase profit margins for title companies. In addition, the title companies can lower the risk of errors and fraud claims by designing and using technology like blockchain. 4 For example, Old Republic announced a new technology, Pavaso, which is an electronic closing solution that uses technology similar to blockchain in order to have a single transparent closing process that cuts down on time and expenses. 5 We are also beginning to see startup companies such as State Title and Spruce that are using technology advancements to help cut expenses. 6

In addition to technology, insurtechs can also challenge title insurance distribution channels and management philosophies. What we have seen occur in the personal lines portion of the property and casualty market, particularly in homeowners insurance, is the emergence of peer-to-peer markets. A group, defined generally by physical proximity of their properties, pool their premiums and risk, essentially self-insuring their risks. This removes the agent from the equation, and individual customers buy directly into this group. If we examine the opportunities for this model in title insurance, we see certain intrinsic differences between title insurance and standard property and casualty insurance that make this a less than ideal approach for title insurance companies. The nature of title insurance, where the premium is paid once for coverage that extends far beyond a single year, does not align well with peer-to-peer insurance models. It is not feasible to have a title insured enter a pool at the moment their policy is written, and remain there indefinitely to pay or recover losses, especially as no additional premium from that insured is collected. As stated previously, title insurance losses can take decades to report, which would necessitate remaining in a pool for that period of time to adequately cover the exposure.

While peer-to-peer may not be a successful model for title insurance, non-traditional offerings have had some success in the property and casualty market and may provide an opportunity for title writers. By isolating and analyzing the different types of consumer purchasers of title insurance, it is possible to see where traditional products are not meeting the needs of specific consumer groups. These disconnects provide a space for insurtechs to step in with a nontraditional product tailored to the needs of consumers. This has happened most notably in property and casualty industry in the area of short-term insurance policies. For example, companies such as Slice offer insurance for home rentals and ride sharing that is only purchased for the time the insurance is needed. Because the consumer does not need a policy for the typical six-month or one-year term, insurtechs have created policies that can be turned on and off as needed. Developing this market can create a lot of front-end sunk costs for the insurtech, but if they determine that there is enough of a demand for a new type of product, they have the flexibility to step in.

When surveying the title industry for those types of opportunities, we look to specific transaction types. For example, a home that has been sold multiple times over a short time period has had several full title insurance policies purchased, which is not always efficient or necessary. This could be a good opportunity for a new product, or a discount that could be applied for homes where a title search was recently run and cleared, even if that search was for a prior owner. Creating these policy efficiencies could lower costs, which would be attractive to a consumer purchasing either a home that was previously owned by “flippers” or entry-level homes, where the length of home ownership is traditionally shorter than that of the “forever” home.

With so many transformations to the insurance sector in this new digital era, insurtechs should be looking to revolutionize the title industry. Lower expense ratios can vastly improve title insurance profit margins as well as lower the cost for title insurance. Insurtechs have an opportunity to help propel the title industry into the digital age.

1 Bonner, Marianne. (August 7, 2019). What is Insurtech and How are Insurers Using it? The Balance Small Business. Retrieved on August 13, 2019, from https://www.thebalancesmb.com/what-is-insurtech-4584490

2 McElroy, Mark. (August 14, 2017). Everything you need to know about eMortgages. Housingwire. Retrieved on August 13, 2019, from https://www.housingwire.com/blogs/1-rewired/post/40981-everything-you-need-to-know-about-emortgages

3Ceizyk, Denny. (March 7, 2019). Should I Get a Digital Mortgage? Magnify Money. Retrieved on August 14, 2019, from https://www.magnifymoney.com/blog/mortgage/should-i-get-a-digital-mortgage/

4Propmodo. (March 8, 2018). Title Insurance Companies focusing on Tech like Their Lives Depend on It. Retrieved on September 4, 2019, from https://www.propmodo.com/title-insurance-companies-focusing-tech-like-lives-depend/

5Old Republic Title. (February 20, 2018). Old Republic Title Announces Pavaso as National eClosing Technology Provider. Retrieved on September 4, 2019, from https://www.oldrepublictitle.com/news/pavaso-for-national-eclosing

6 Digital Insurance. (August 23, 2018). New Insurtech takes on title insurance. Retrieved on August 16, 2019, from https://www.dig-in.com/articles/new-insurtech-takes-on-title-insurance